We're Doomed

The Bond Markets Are Turning Against The UK. Unfortunately Labour Doesn't Understand Them

As we spiral into economic meltdown it is incumbent upon the media whom we fund to report facts accurately. I’ve previously castigated Evan Davis for believing BBC Verify data. Now Sarah Montague has gone one further by accepting commentary from the Resolution Foundation, (the lefties’ favourite think tank) as Gospel.

On 20th August she was seeking economic wisdom from them and was interviewing James Smith (the Resolution Foundation’s research director) about the consequences of the surge in inflation and the Bank of England’s cut of interest rate. Mr Smith stated that reducing the Bank of England’s base rate was “good news” for the Chancellor as a “reduced cost of borrowing translates to a reduced cost of borrowing for the government.” (29 minutes and 50 seconds into the interview).

That is completely wrong.

There is no linkage between the Bank of England rate and the interest rate paid by the government on its debt, and there never has been. Ms Montague let it pass, which begs one to question of the worth of a journalist who either doesn’t understand the topic being discussed or who chooses not to ensure that her product is accurate. (She’s paid £250,000 of our money a year.)

Before joining the Resolution Foundation Mr Smith “worked in a range of roles at the Bank of England and in the civil service, leading analysis of macroeconomic issues for policy.” Either he doesn’t understand the basics of government debt (a trait shared by Rachel Reeves, who also worked in the Bank of England) or he was lying (a trait shared my many lefty politicians). Being charitable I’ll explain things for them both.

The Bank of England Base Rate

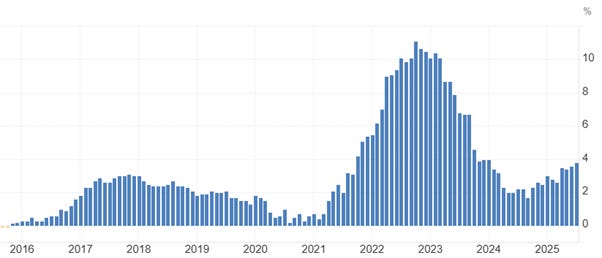

The Base Rate is set by a committee of the Bank of England, chaired by the Governor. Their remit is clear; to set rates to keep the UK’s inflation as measured by the Consumer Price Index (CPI) at 2%. That’s it. Nothing about growth. Nothing about foreign exchange rates. Nothing about gilt yields. All they must do is use the base rate to manipulate the economy to deliver CPI of 2%. As the chart of CPI inflation below (from Trading Economics https://tradingeconomics.com/united-kingdom/inflation-cpi ) shows, it’s not going well.

Quite why it’s so hard to manage inflation is (thankfully) beyond the scope of this article. The short version is that the Bank has but one control, the base rate, whereas there are myriad factors that affect prices in the economy. These include Russians starting wars, bond traders breaking the banking system, covid (natch!), tax rises and Ed Miliband driving up the price of energy. All of which keep the Governor and his committee busy thinking about what the base rate should be.

In the words of the Bank of England itself the BoE Base Rate “determines the interest rate we pay to commercial banks that hold money with us. It influences the rates those banks charge people to borrow money or pay on their savings. ” While, somewhat controversially, the Bank of England no longer requires banks operating in the UK to deposit cash with the BoE in practice most banks do as it makes their own operations simpler and more robust. The BoE base rate is used as a reference point for banks lending to each other and to customers.

Raising the base rate increases the cost of borrowing, which in turn slows an economy down which should eventually reduce inflation. Similarly reducing the base rate makes money cheaper thereby reducing the costs and risks of expansion. That expansion eventually delivers growth (which might lead to inflation.)

Inflation is that it increases the prices of goods, therefore making money less valuable. This can be devastating in the long term. When I was 13 a first class stamp cost £0.03 and a Mars Bar cost £0.10. Some half a century later the prices now are £1.70 and £1.10 respectively. £1 today is about as valuable as 5p in my youth. That’s inflation.

Government Borrowing

The government raises money by auctioning bonds, British ones being called Gilts (the financial service industry thrives on obfuscation). The nominal value of a single gilt is £100. It will have a “coupon” (interest rate) of (say) 4% and a duration (“maturity”)of (say) 10 years. Whoever buys it will receive ten annual interest payments of £4 and at the end of the tenth year a repayment of £100.

The thing that is not fixed is the price of the gilt. When the auction starts all those bidding will have done some pretty simple maths to come up with a net present value of the payments that the government is offering. They then bid. The Treasury’s Debt Management Office (“DMO”) then fills its needs from the highest price down (Gilt auctions are oversubscribed). At the end of that the government has the money it needs, the investors own their gilts and the cost of the government’s borrowing has been set.

Here's the important bit. The government was prepared to pay £4 in interest a year on £100, a nominal 4%. Perhaps the markets were only happy to pay £90 for the gilt. The coupon remains £4 so the gilt’s yield is 4.44% (£4 coupon divided by the £90 spent on buying the gilt). At the next government auction (they happen every few days ) the DMO can either set the coupon higher or continue to sell at a hefty discount. Whatever they do, if the market thinks that a yield of 4.44% is right price that’s how they’ll bid. The government can take it or leave it. As the UK government needs to borrow £100 billion a year (or more) leaving it is not an option.

Between auctions the gilts are still traded – with some £3 trillion of government debt there are £3 trillion of gilts in existence. Each trade is recorded and each trade sets the yield for that gilt. Until the gilt matures all the government does is pay the coupon at the specified time to whoever owns the bond on the payment day. For 2025-26 those coupon payments total some £111 billion, about 8% of all government expenditure (of our money).

Inflation

£111 billion is just the interest. As bonds mature the government must repay their face value. The government issues a plethora of bonds with varying maturities – currently the average maturity is about 14 years. So every year the government must repay some £210 billion of debt (on top of the £110 billion that it needs to borrow). The government has no money so it must issue more bonds to raise the money to make the payments. This is where inflation becomes important. £100 in 2015 was equivalent to £118 today, but the government need only pay £100 of today’s less valuable pounds to repay a £10010 year gilt issued in 2015. In that narrow sense inflation is the borrower’s friend.

Bond holders therefore watch the inflation rate like hawks – an unanticipated bout of makes their net present value calculation wrong and that they overpaid. Solution? Sell the bond, salvage the capital and invest in something else. Of course every other bond holder is doing the same maths so they will pay less, perhaps £88. That makes the yield of that bond 4.54%. This has absolutely no effect on the quantum of interest that the government must pay, nor on the repayment amount. It does have a substantial impact on the market’s perception of the government’s next bond issue.

Bond holders use many sources to anticipate and calculate UK inflation rates. These include other bond yields, a whole plethora of technical indicators, the Bank of England’s own inflation report and the BoE Base Rate. If inflation is over 2% and rising the base rate should be increasing to control inflation. If inflation is under control then the markets will demand less yield. If, as is the case in the UK today, inflation is rising and the Bank cuts rates inflation will not be reduced. Markets will therefore demand a higher yield to art with their money. As the Trading Economics chart below shows, that is precisely what is happening today.

The Resolution foundation’s Mr Smith is 100% wrong. The falling Bank of England rate has driven the cost of government borrowing up. Why Smith should say otherwise escapes me. If Sarah Montague doesn’t understand she’s not worth £250,000. Both should know better. Both are misleading the public about the economic devastation that is heading our way.

It gets worse.

Until last year the Resolution Foundation was run by Torsten Bell (formerly Henrickson-Bell). He presumably hired Mr Smith. While the ex-minion is adding to the misinformed waffle on the BBC, the guy who hired the idiot is now the Minister for Pensions (which he wants to tax).

Bell ran Ed Miliband’s disastrous general election campaign in 2015. His expertise in the Treasury was child poverty. It’s not clear whether that means making children (and their parents) poor or by creating wealth. He’s now the Minister for Pensions and wants to tax them. He has just been drafted in to help Rachel from accounts draft the budget. That’s like trying to extinguish a fire by throwing petrol on it.

This will end in tears.

Ours.

If you enjoyed this article please remember that Views From My Cab is a reader-supported publication and subscribe, which costs nothing but makes the SubStack bots more generous.

Alternatively you could make a small, one off donation to defray my production costs. I am hugely grateful for every donation. The simplest method is via Buy Me a Coffee.

Ah Brian Walden. Click bait is no substitute.

As Liz trust proved, credibility is everything. Whoever takes over from this shower is going to have to persuade the markets thay they have a plan that might work. Starmer’s drive for growth is an abject failure and I fear the markets won't be impressed by the Reeves/Bell solution of demonstrating that Laffer was right by being on the wrong side of his curve. It's not impossible, but it won't be easy.

There is a general problem with much of the MSM. Leaving aside for a moment accusations of bias, I am old enough to remember Brian Walden and the current crop of journalists are simply lightweight and have neither rigour nor curiosity. Perhaps that is simply a reflection of the times we live in, where everything is shrunk into bite size pieces for the audience or the consequence of performance over substance.

My other thought is that UK government debt commands a premium because Starmer & Co have no real idea how to get to grips with borrowing. Whatever additional sums the government raises will be used to buy off the public sector and pay off debt interest. Credibility counts for much IMO.