Nightmare on Downing Street

Next week's budget will not be able to paper over the incoherent contradictions of this government's policies. Expect trouble.

The general opinion of the world outside government is that Rachel Reeves’ first budget will be a Nightmare on Downing Street, with the taxpayer being squeezed to death, the economy giving up the ghost, the tax take falling, public finances failing and public services collapsing. Warnings of economic disaster are three a penny. They’re often wrong – particularly the 364 notable economists who destroyed their reputations with an open letter to the Times predicting disaster in March 1981, just before the 1980s boom kicked off. I’m not an economist, indeed I don’t even have a degree in PPE but although I am a “working man” and the Prime Minister says he won’t raise my taxes I am very, very concerned.

That the public finances are in a fix is no surprise, indeed most chancellors since 1997 have faced varying levels of disaster and overspending. (For a detailed explanation of where we are and how we got here read some recent articles by Ewen Stewart, who is an economist). Elections often turn on economics but, strangely, the General Election this year didn’t. The Tories didn’t have much to brag about and Labour were keen to be taken as economically safe. There was little in the way of policy, less interrogation by the generally left leaning media and Sir Kier spent all his time promising not to raise taxes for “the working man”, i.e. me.

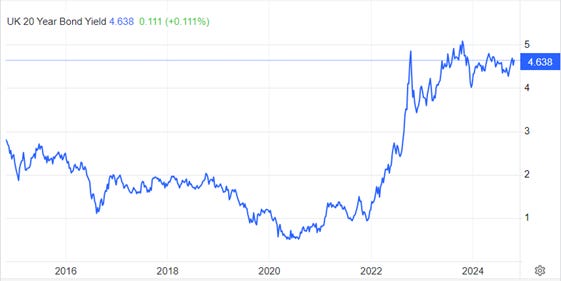

Sir Keir is not the first politician to promise no tax rises and then raise them – President George “read my lips, no new taxes” HW Bush being the most obvious. Starmer and Reeves may yet be the most brazen. Having “discovered” a £20 (ish) billion black hole in the nation’s finances, thrown money at doctors and train drivers and committed wholeheartedly to the extravagance of net zero, spending is definitely rising. Worse, UK Bond yields are rising, as the charts below from Trading Economics show.

That unavoidably means that the UK’s interest payments on its massive debt pile will also increase. To be clear, a 10 year gilt issued in 2014 (and therefore due to be replaced this year) yielded 2.3% when issued. A replacement (issued today) will be almost twice as expensive at 4.1%. While the Treasury’s Debt Management Office may do a little better than spot market prices there can be no doubt that the national debt’s interest costs will rise. As we’re running a deficit, the deficit will rise which in turn means that the national debt will rise. While this is not of Reeves’ making she, like anyone who cared to look, knew fine well what the situation is long before she came to power. Raising money for the UK government is increasingly expensive.

Reeves is, apparently, contemplating some nifty re-definition of what constitutes debt in order to get round the constraints of the Office of Budgetary Responsibility (OBR). If she succeeds in this sophistry she will have more room to invest in the hope of delivering growth.

Unfortunately it’s not the OBR that lends money to the UK. While they have a role in commenting on debt levels, the only people that buy UK debt are bond investors. They price their offers in a global market. While a bond strike is unlikely it’s hard to see reasons for investors to buck the market and accept lower yields. How the OBR factors this into its calculations and recommendations is far from clear. The UK won’t be getting any favours from the bond market.

The other great hope for Reeves is growth. The Labour government’s theory is that if they borrow tens, or even hundreds, of billions to “invest” in infrastructure and public services the economy will buck up and deliver growth. That will create jobs, that will create tax revenues and everything will be peachy and re-election in 2029 will be assured.

The flaws in this theory start with the definition of “invest”. In non-political parlance an investment is something which yields a profit. All the money invested in wind farms only yields a profit if the government (that is, we taxpayers) pays a subsidy, now disguised in the “strike price.” Were there no subsidy there would be no wind farms, which is what happened last year. Without subsidy wind farms (and other green energy schemes) are a liability - that is they are a constant drain on the public purse. Confusing assets with liabilities is the sort of mistake that bankrupts companies and lands directors in jail. In government it just racks up the national debt and sends chancellors to the House of Lords or the media.

The definition of growth is problematic too. It is generally accepted to mean an increase in the UK’s Real Gross Domestic Product (GDP). (Real means after accounting for inflation). Unfortunately the calculation of GDP includes all government spending. So If Rachel borrowed £300 billion and splurged it in our economy (current GDP about £3 trillion) that would look like 10% growth. What she spends it on matters not to the calculation. Train drivers, hospitals, wind farms or debt interest – if it’s government spending it’s part of GDP.

Tragically, Reeves intends to spend heavily on net zero, that is she will underwrite Mad Ed Miliband’s wind obsession. As I have shown before, wind generation pushes up the costs of electricity. In the chart below, electricity cost clearly tracks the proportion of it that comes from renewables – hardly surprising as an idle power plant is expensive, whether its a gas power station when the wind is blowing, or a wind farm when it isn’t.

Expensive energy is not conducive to economic growth, and the UK already has some of the most expensive electricity in the world. There’s a reason that the sparsely populated Nordics are becoming locations of choice for data centre operators. It’s not love of the trolls, fjords or Abba that are driving this; the Nordics have abundant, reliable and cheap power.

The inevitably expensive electricity in the UK puts a further bind on this government’s plans, which hinge on spending boosting the economy and creating jobs through Artificial Intelligence (AI). That means more data centres. The data centres in London alone already consume about 3% of the UK’s electricity generation. Goldman Sachs thinks data centre electricity demand will rise by 160%. It true that means that London’s data centres alone would require pretty much all the output of the (still unbuilt) Hinckley Point C. Where will the electrons come from? In the UK we’re actually reducing electricity generation with the closure of coal and all bar one nuclear power station by 2026-7.

So here we have Labour’s central policy incoherence exposed. The green plan for jobs and the AI plan for jobs (and fixing the NHS) are not compatible. Even if they were, raising the capital for them will be unaffordably expensive, meaning that the theoretical solutions won’t deliver growth. Reeves will probably get the money she seeks – no bond holder has an interest in financial collapse, but it won’t deliver jobs and it won’t keep the lights on. Reeves will face the same problems next year, with an even bigger debt mountain and a further black hole that will be of her own making.

Whether or not the “working man” pays more tax, his cost of living will rise inexorably. He may not even have a job if the Rayner reforms are as onerous on business as they appear. The Labour party’s manifesto was an exercise in ambiguity and its central tenet, “Things will get worse before they get better”, is already looking wildly optimistic. The UK’s electorate has been sold a dud. Its been conned.

When the working man realises that he will also discover that he has no recourse against a state machine backed by a large parliamentary majority. He's not going to like that any more than he likes uncontrolled immigration. If, or when, there are power cuts this winter anticipate discontent.

These posts don’t write themselves. The research takes time and money too. If you enjoyed this article please remember that Views From My Cab is a reader-supported publication and consider becoming subscriber (free or paid).

At the least please share it widely.

If you prefer making a one-off direct donation the easiest way is to buy me a coffee: